After attending the NetFinance Conference in Miami this year. There were two topics in particular that I found most interesting:

- Digital strategies to support the Omni-channel experience

- Is Personal Finance Management (PFM) dead?

With this digital core, a bank can deliver the real-time access to information that banking customers now desire. A digital core will also enable banks to provide a consistent experience regardless of what channel how customers choose to access their bank (e.g., mobile, in-person, smart watch, etc.).

Having read Chris' book: Digital Bank a few months ago, I agree. The outdated Omni-channel structure where legacy sits on top of legacy enables disruptors like Simple and Moven to quickly enter the arena of banking and make huge waves. The transition to a digital core sounds both costly and a tall mountain to climb, and it is, but it's an evolution that needs to happen for banks to move past becoming a 'mobile' bank and towards becoming a digital bank.

The second topic, is PFM dead, was of particular interest to me because it aligned with some research I conducted in 2014. If your definition of PFM is tools by which customers can self-manage their spend and create budget goals themselves, then yes PFM is dead. But if you think about PFM as the usefulness that can be derived from this type of analysis, then no, PFM is NOT dead but very much alive.

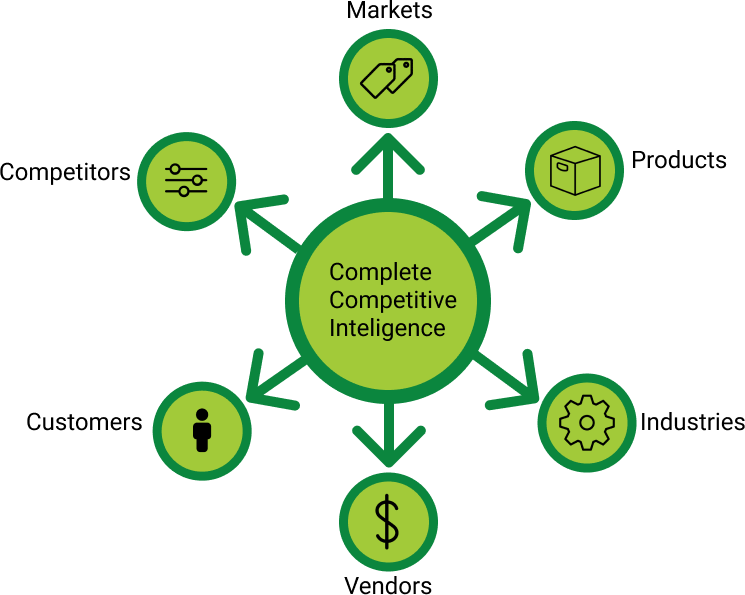

Our competitive research has shown that banking consumers (those who are affluent and to a lesser extent all consumers) not only find this type of information useful, but they want their banks to be the provider of such insight. It is not enough for banks to simply present this data to consumers, but rather share this insight in both a contextually relevant and actionable way. Consumers want their bank to be a 'trusted advisor'.

Banks have a wealth of information, historical and current behavior, to leverage that can enable them to better advise their customers of the behaviors and/or products and services they can benefit from to become more financially secure or achieve their goals. Making sure the message is goal oriented and clear for consumers to see how these actions will benefit them is critically important. However, the push to new products/services needs to be subtle and NOT the goal of PFM 2.x. The value of these types of insights can go a long way to instill loyalty, a more personalized touch, and a greater sense of financial confidence for your customers.

If you are interested in learning more about either of these topics, how to execute PFM 2.x, or are interested in how Key Lime Interactive can assist you in your transition to becoming a digital bank, please feel free to reach out to me.

The transition from Omni-channel to a digital core will happen faster than you think, so stay informed and ahead of the curve.

Comments

Add Comment