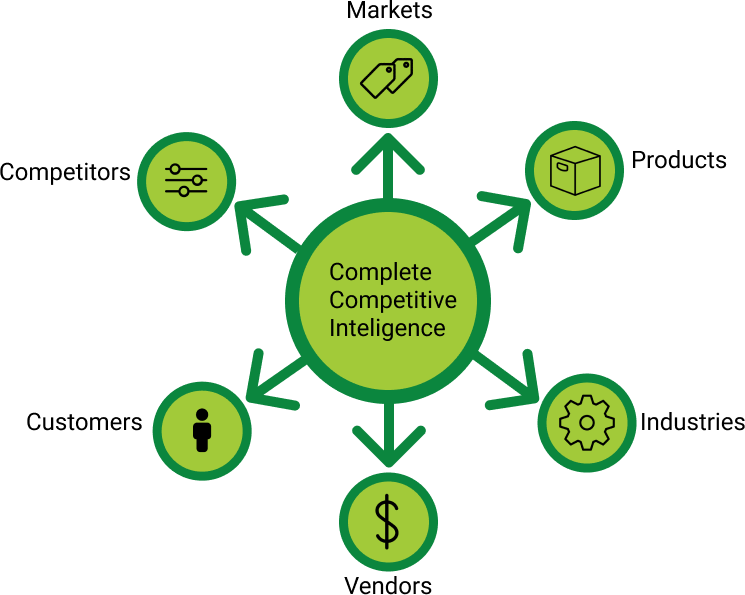

Competitive Intelligence (CI) serves as an analysis that provides individuals with a comprehensive understanding of competitors products, services, capabilities, weaknesses and value propositions. This method is very similar to a competitor analysis, but has a larger scope to encompass extensive information on topics concerning the market landscape between competitors. This analysis method should be specific and timely to promote quick decision making. It should also be assembled to represent a report - displaying valid metrics that were created through the use of robust tools to display an accurate ranking of competitors. There are several steps researchers should take to create a successful competitive intelligence analysis.

Gathering competitive intelligence is only half the battle, so let's walk through the steps needed to complete this process with ease…

#1 It’s essential to identify who this report will target. Any company, in any market, will have several competitors that they track through the use of CI. In light of this, your report will include a mix of direct competitors (companies who are very active in the target market) in addition to various companies who are in similar industries/implement the same business model. Creating a report with the right combination of competitors will ensure that you will display the right blend of strategies, tactics, and best practices to display in your findings.

#2 A valuable insight required for this analysis is the ability to recognize the stakeholder(s) involved. Stakeholder expectations will help guide you through this process. The products/solutions used for the analysis will directly reflect the stakeholders you should reach out to. Stakeholders will vary depending on what you’re trying to achieve but examples of relevant titles include Chief Technology Officers, VP’s of Product Engineering, or Heads of User Experience departments.

#3 Now that you have the target competitors/market in mind you can decide the objectives of the report. Compile the report based on exploratory questions you would like to answer. Typically this aspect of the report should contain intel and insights from each competitor in addition to:

- Features of products in comparison to competitors

- Analysis of marketing and social media strategy

- Details of customer ratings of product/service features of each competitor

- Positioning of the competitors' products

- Improvements on their brand value

- Enhancements in their customer service

- Reductions in customer rejects

- Enlarging their marketing footprint

#5 Templates will be your best friend throughout this process. To make this task easier on yourself, it’s encouraged to plug in data as you go to ensure that the data collected is recorded and productive towards your goal. Templates should be generated in the early phases of this process - and should only be shared to those who will be responsible for updating them. The most common themes presented in CI templates include:

- Company Data (revenue, expenses, employees, locations, company history)

- Financial Data (performance metrics, business segments, assets, returns, capitol)

- Product Comparisons (existing/upcoming features, pricing, marketing, customers)

- Strategic Comparison (strengths, weaknesses, threats, opportunities)

- Quantitative Scorecard (customer support/reviews/reputation, assets, core product features)

- Marketing Intelligence (target audience, website, traffic, marketing/sales collateral)

#6 When assembling your report, it's essential to ensure that the report is easy for others to read and interpret (presenting quantitative findings in a spreadsheet-like structure). It's beneficial to make use of different tabs for each leading competitor while displaying the different metrics referenced throughout the report. You can organize the visual aspects of this report to your preference; however it is critical to prioritize information regarding your reports identified trends, factors, and patterns.

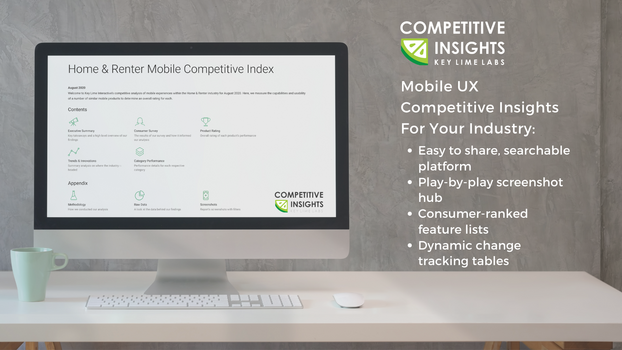

Key Lime Interactive works on several competitive intelligence reports per year for various different industries. Our reports provide current insights, rankings, and trends that are compared, ranked, and (visually) charted. As a leading partner in strategic user experience (UX) competitive analysis, Key Lime Interactive has been publishing reports (for public use) since 2011. These reports allow for others to track mobile UX design changes and trends across the biggest brands, with the ability to:

- See side-by-side mobile comparisons

- Acquire access to year-over-year performance ratings

- Deep dive of features through multi-device/OS coverage

To learn more about the benefits of CI reports, and the robust information they can provide, Key Lime Interactive's Competitive Insights Platform, or contact us for more information.

References:

Contify: Competitive Intelligence Analysis: An Actionable Guide on Reports, Metrics, and Tools

Paperflite: Competitive Intelligence Done Right

Key Lime Interactive: The 1st Platform for Mobile UX Competitive Insights

Key Lime Interactive: How to Use Competitive Intelligence to Your Advantage

Key Lime Interactive: Why Competitive Intelligence (CI) Matters

Comments

Add Comment